In the land down under, where dreams soar as high as the Sydney Opera House sails, your financial health is crucial.

Imagine good credit in Australia as your personal boomerang; cast it wisely, and it’ll ensure prosperity returns to you, opening doors to myriad opportunities. Whether you’re eyeing a cozy home by the beach, a reliable car for the outback adventures, or simply the peace of mind that comes with financial security, a robust credit score is your ticket.

Understanding Credit Scores

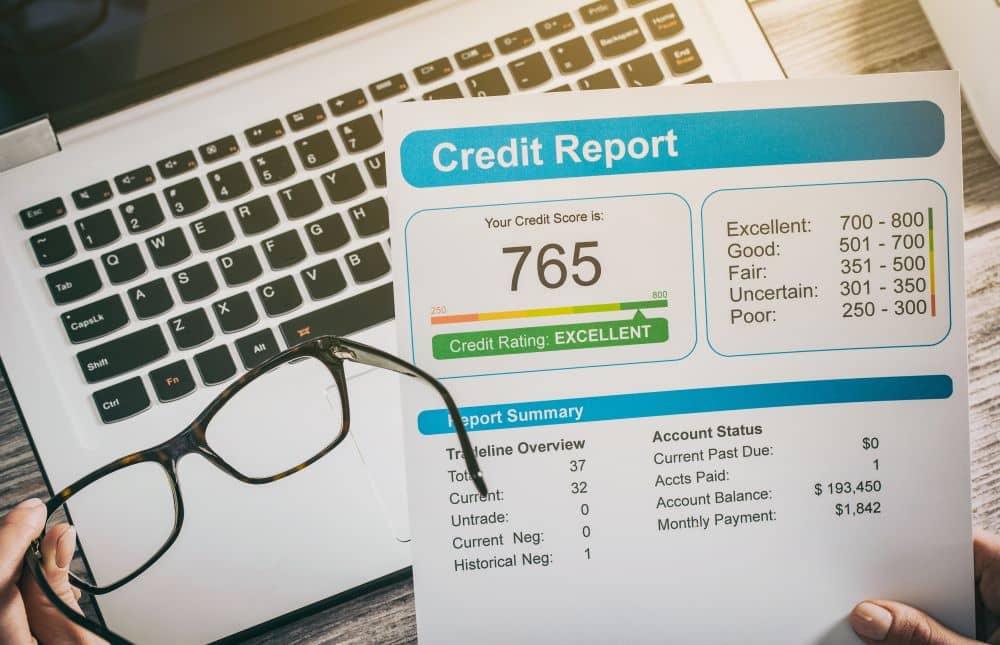

What exactly is a credit score, you ask? Think of it as a financial report card, a single number that sums up how reliable you are when it comes to managing and repaying debt. It’s the first thing lenders look at when you knock on their doors, hoping to borrow some cash or apply for a credit card.

The Impact of Good Credit

Good credit doesn’t just open doors; it unlocks better interest rates, favorable loan terms, and can even make the difference in landing that rental property you’ve been eyeing. It’s like having a VIP pass in the financial world, giving you preferential treatment wherever you go.

Building a Good Credit Score

Building a good credit score is akin to building a house; it requires a solid foundation, the right materials, and time. It starts with basic steps like paying bills on time, reducing debt, and making wise financial decisions.

Tips for Maintaining Your Credit Health

Maintaining good credit is like tending to a garden; it requires regular attention and care. Simple habits like checking your credit score regularly, using credit wisely, and avoiding unnecessary debts can keep your financial garden thriving.

The Role of Credit in Financial Planning

Incorporating credit into your financial planning is crucial. It’s about understanding how to use credit as a tool to achieve your goals, whether it’s buying a home, investing, or saving for retirement.

Navigating Loans and Credit

Navigating the world of loans and credit can be daunting, but understanding the basics, like the difference between secured and unsecured loans, can help you make informed decisions that align with your financial goals.

Good Credit and Mortgage Opportunities

Good credit can be the key to unlocking the door to your dream home. Lenders are more likely to offer competitive mortgage rates and terms to those with strong credit histories, making home ownership more accessible.

Credit Cards: Friend or Foe?

Credit cards can be a double-edged sword. Used wisely, they can help build your credit score and offer rewards. However, mismanagement can lead to debt and damage your creditworthiness.

Repairing Damaged Credit

If your credit score has taken a hit, don’t despair. Repairing damaged credit is possible with time, patience, and a solid plan. Steps include consolidating debts, setting up payment plans, and gradually rebuilding your credit.

Good Credit and Your Financial Freedom

Ultimately, good credit is about more than just numbers; it’s about freedom. Freedom to pursue your dreams, make choices, and live a life unburdened by financial constraints.

Good credit is not just a financial tool; it’s a cornerstone of your financial freedom. By understanding, building, and maintaining good credit, you’re not just securing loans or credit cards; you’re paving the way for a prosperous future in Australia.

A good credit score in Australia typically ranges from 650 to 750 on a scale of 0 to 1200, depending on the credit reporting agency.

Australians can check their credit score for free once a year from major credit reporting agencies like Equifax, Experian, and Illion.

Yes, applying for multiple credit cards within a short period can lower your credit score as it may indicate financial distress to lenders

Yes, paying off your credit card balance in full every month can positively impact your credit score by demonstrating responsible credit management.

Are you struggling with Bad Credit? Register with Enhanced Credit Repair today so see how we can improve your credit score in as little as 30 days.